Table of Content

The interest you pay on a mortgage on a home other than your main or second home may be deductible if the proceeds of the loan were used for business, investment, or other deductible purposes. Otherwise, it is considered personal interest and isn't deductible. You may want to treat a debt as not secured by your home if the interest on that debt is fully deductible whether or not it qualifies as home mortgage interest. This may allow you, if the limits in Part II apply, more of a deduction for interest on other debts that are deductible only as home mortgage interest. She sells the home for $100,000 to John, who takes it subject to the $40,000 mortgage. John pays $10,000 down and gives Beth a $90,000 note secured by a wraparound mortgage on the home.

This means that you can no longer deduct the interest on home equity loans that you use to pay off debt or put toward an emergency expense. To take advantage of this tax break, you’ll need to itemize your deductions at tax time. In addition, you cannot deduct the interest on a mortgage that you took out on your main residence to buy a secondary residence. For the deduction, the proceeds of the home equity loan must be used on the qualifying residence that is secured by the loan. If you refinanced a qualifying home-secured loan after October 13, 1987, for an amount not exceeding the remaining mortgage principal on the debt, the refinance is also considered inherited debt. A qualifying loan must be for a taxpayer’s primary or secondary residence.

Can Home Equity Interest Be Deducted From Income Tax?

Both loans are secured by the houses purchased with the funds, respectively the principal residence and the secondary residence. In this example, the loans are secured by the appropriate qualified residence. Only a percentage of the total interest paid by Kat is deductible. In January 2022, Tom took out a $300,000 mortgage to purchase his primary residence. In May 2022, he took out a $250,000 mortgage to buy a vacation home. In this example, the total value of Tom’s loans does not exceed the $750,000 limit, the loans are secured by the appropriate qualified residence, and all interest is deductible.

Prior to the Tax Cuts and Jobs Act , you could deduct interest on up to $1 million of home acquisition debt (or $500,000 if you used married-filing-separately status). Home acquisition debt means loans to buy or improve a first or second residence. When it’s time to do your taxes, here are a few things to know about claiming the home equity loan interest tax deduction.

Is Home Equity Loan Interest Tax Deductible in California?

After totaling your itemized expenses, including your home equity loan interest, and comparing them to your standard deduction, you have to decide whether itemizing is to your advantage. Married filing jointlyFiling separately/singleHead of household2021$25,100$12,550$18, $25,900$12,950$19,400You can either take the standard deduction or itemize — not both. Proof of how home equity funds were used – Keep receipts and invoices for any expenses that significantly improve the value, longevity or adaptability of your home.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. We are an independent, advertising-supported comparison service. FeesAppraisal, Amounts charged for services.Notaries, Amounts charged for services.Points Figures Form 1040, Schedule A, How To Report, Table 2. Where To Deduct Your Interest Expense Form 1040, Schedule C or C-EZ, Table 2. Where To Deduct Your Interest Expense Form 1040, Schedule E, Table 2.

Legacy debt

As a general rule of thumb, capital improvements add significant value to your home, and regular repairs on existing structures aren’t eligible for tax deductions. Instead, it is classified as home equity debt; so, you can’t treat the interest on that loan as deductible qualified residence interest for 2018 through 2025. Each lender you have a home loan with should give you a mortgage interest statement in January to show you — and report to the IRS — how much interest you paid them during the previous tax year. This form will also show your loan origination date so you know which deduction limit applies. You may not receive this form if you paid less than $600 in interest.

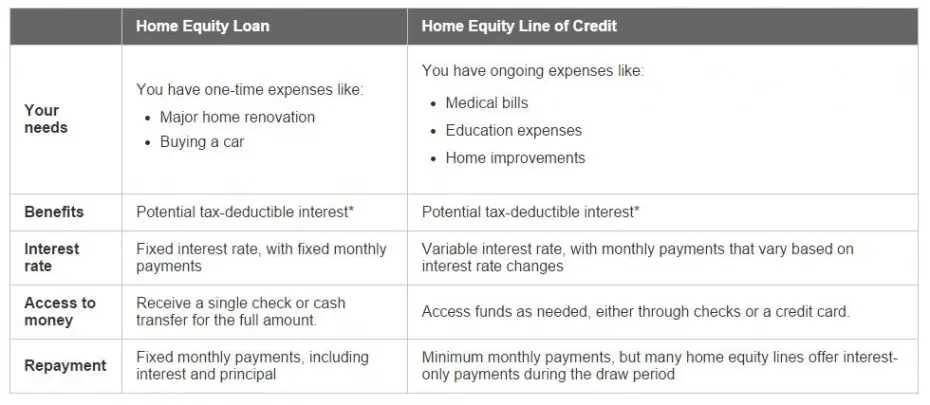

Finding a HELOC or home equity loan lender that will approve your loan with no documentation may be tricky and put you at risk of becoming a victim of a lending scam. Interest on a home equity loan or a home equity line of credit is only deductible if the proceeds are used to “buy, build or substantially improve” upon the home that secures the loan. This means that interest cannot be deducted if you used the proceeds to pay personal living expenses. The deduction applies to interest paid on home equity loans, mortgages, mortgage refinancing, and home equity lines of credit. These loans typically offer lower interest rates than unsecured debt, such as credit cards or personal loans.

Is interest on a home equity loan deductible as a second mortgage?

Qualified homes, Qualified HomeQualified loan limitAverage mortgage balance, Average Mortgage BalanceWorksheet to figure , Table 1. LITCs represent individuals whose income is below a certain level and need to resolve tax problems with the IRS, such as audits, appeals, and tax collection disputes. In addition, LITCs can provide information about taxpayer rights and responsibilities in different languages for individuals who speak English as a second language.

The loan proceeds, however, must be used to “buy, build or substantially improve” the home that was used to secure the loan. Kim Porter is a former contributor to Bankrate, a personal finance expert who loves talking budgets, credit cards and student loans. When she's not writing or reading, you can usually find her planning a trip or training for her next race. Home equity loans and HELOC interest deductions are only allowed under the new TCJA rules if the loan is used to purchase, build or substantially improve the home that is secured by that loan. The Tax Cuts and Jobs Act lowered the dollar limit of home loans eligible for the mortgage interest deduction.

If your mortgage loan was taken out on or before October 13, 1987, there is no limit to the interest deduction on your mortgage loan. This inherited debt (the IRS still uses the old term “grandfather”, despite its racist roots) is fully deductible if it was secured by your qualifying home at any time after that date. There are also no restrictions on the use of proceeds for inherited debt to qualify for the home loan interest deduction.

We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. The amount of interest you can deduct on your tax return depends on when you loaned it, how much you loaned, and how you use the loan proceeds.

No comments:

Post a Comment